Matched Loans

Where finances are often one of the biggest obstacles to starting new churches or campuses, AoG wants to help overcome this by making funds available in the first and most crucial part of the journey. Through the provision of matched loans, we want to strategically partner with you to help turn the vision into reality!

Up to a maximum of £50,000 raised and secured by the new churches, AoG will match with the same level funds. While the funds will need to be repaid over a period of time, interest-free, it will mean that new church plants will have a vital source of income right at the beginning, allowing them to set foundations for growth from the start.

Matched loans are for individuals or churches planting in new geographic locations. You may want to apply for start-up costs before launch, operational outlay in the first year, publicity and profile, staffing expenses, programme consumables, or anything else that will help you get the new work off the ground (excluding property purchases). Loans released will be subject to submission of strategic plans and an agreed budget. There is a streamlined process for applications under £10,000.

Matched loans will be available for any AoG GB church or individual AOG minister wanting to plant in a new location. This opportunity is not for churches seeking to fund ministry expansion, although new churches can apply for a loan up to 14 months after the official launch of their first service.

AoG Ministers-in-training can also apply, or those without AoG ministerial status, but with endorsement from another AoG church. Churches or individuals new to AoG GB are also welcome to apply, if they are prepared to join the movement and embrace the relevant training or transition process.

Church plants also include new campuses of existing churches, where they are reaching out into a new geographical location.

AoG GB has a vision for 400 new churches by 2028, so a funding pot of £2.2 million has been established to help make that vision a reality, to actively get behind churches that plant over the coming years.

On initial application, churches can borrow up to £50,000 (there is no minimum amount), but funds will only be released when it is demonstrated that the same level of funding has been secured. Pledges from outside sources will be acknowledged, but the disbursement of funds from AoG will only be made when the funding has been received and can be clearly demonstrated. In some cases, the release of funds will be staged periodically rather than advanced at the start.

Subsequent requests for further funding can be made by the church plant, where the initial amount applied for has not exceeded £50,000 in the first application.

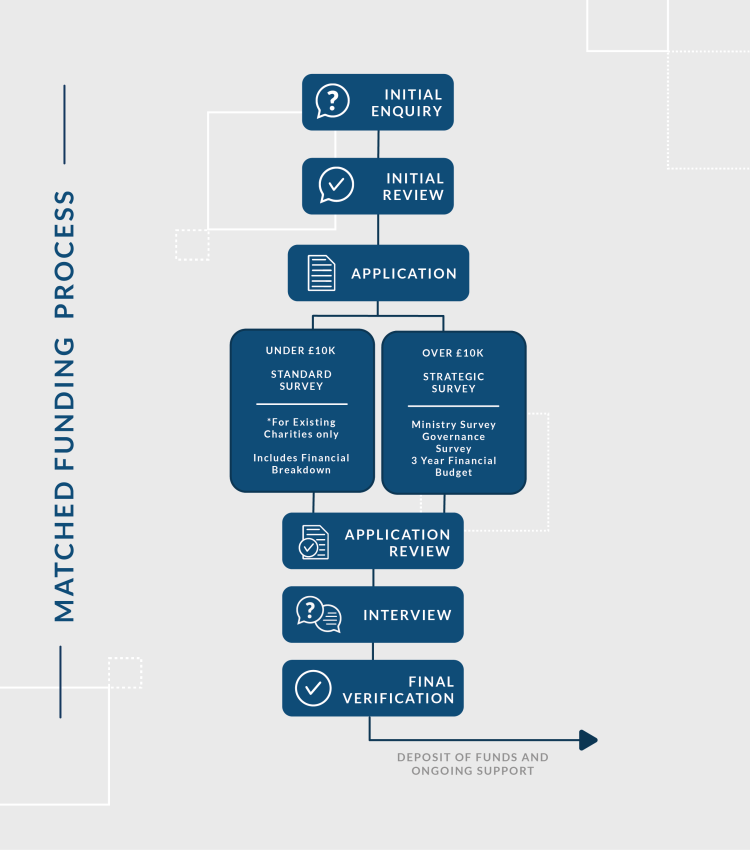

New church plants, new campuses of existing churches and individual church planters are eligible to apply for a matched loan. The first step is to complete an Initial Enquiry form to briefly outline why you want to start a new church, where and when you hope to plant, and how AoG can support you.

From there, you will progress to the next relevant stage of the application process, depending on the level of loan applied for and nature of your church plant.

Matched loans are ideally applied for before the launch of your first service, but in some cases up to 14 months after you start. Applications can also be made up to 12 months in advance of the church launch, but the repayment term will commence from the date funds are released.

The timeline for each application is based on when your initial enquiry form is received, relevant strategic plans are submitted, and when the approval process is completed.

After your initial enquiry is reviewed, depending on the amount of funding you require, you will enter the formal application process. For loans of £10,000 and over you will be required to complete the following:

1) Ministry Survey

This will help provide a clearer picture of your vision, your context, your intended plans and what model the new church will adopt.

2) Governance Survey

This will help clarify your funding requirements, ability to repay the loan, and how the new church will be legally and operationally governed.

3) Financial Budgets

A detailed budget for the first year (of the agreement) will demonstrate where a matched loan will be invested and what expenses you anticipate in the coming months. A second and third-year overview will also project where you expect things to head in the coming years.

For loans of under £10,000, there is a more streamlined process that will require submission of a single survey and budget breakdown of the loan application.

On submission of your formal funding application, you will also need to pay a one-off £250 administration fee in order to set up the loan repayment scheme.

AoG GB will strive to keep the turnaround time on all applications as short as possible, but depends on how soon the necessary documents are submitted and reviewed.

These documents will set the groundwork for assessment with the Church Planting Team, leading to an interview to set the parameters of the funding agreement. The process of application is robust, but is also meant to help you really think through your plants to plant!

Only when the approval process is complete will the agreed funds be released. You should not make any financial commitments until a formal agreement has been signed with AoG GB.

The fund received is ordinarily repayable within a five-year period from the date of formal agreement with AoG GB. There is no obligation to make repayments within the first 12 months, but the repayment period will formally commence from month 13, up to the end of the term, which will be month 60. Within the duration of the agreement, early repayment can be made at any point with no penalty.

For example, if you apply to AoG for £10,000, an agreement may commence from 1st September 2022, when funding will be released. Repayments would commence on month 13 of the agreement, 2nd September 2023. At £250 a month, the fund would take 40 months to pay back, ending on 2nd December 2026.

Alternatively, with an application for £30,000, the repayments could be spread over the full term. Repayments would be £625 a month, commencing on month 13 and the final instalment being made on month 60.

There is some flexibility in the loan repayment term depending on circumstance, by prior agreement.

For a new church plant, part of the application process is to identify a Primary Partner that will act as a guarantor. This could be another church or ministry who will formally agree to underwrite the arrangement with AOG, in the unlikely case that repayments are defaulted.

Where an existing church is planting a new campus, and they can effectively demonstrate a capacity to guarantee repayment of the loan themselves, a Primary Partner will not be required. However, in both cases, a legal agreement will be signed at the end of the approval process before funds are deposited.

As part of the process, our Church Planting team will offer ongoing support and evaluation to help sustain and grow the new church. The purpose of offering matched loans is to equip, fund and set strong foundations for growth – not to tell you how to do church ministry.

However, over the five-year repayment term you will be required to offer some formal feedback, to help capture growth data but also evaluate your ministry direction. This is not meant to be additional pressure, but a healthy way of tracking development of the vision and to help identify areas for further attention or training.

When the matched loan is paid back in full, we ask that the planted church agrees to contribute a minimum of 5% of the AoG matched funding back into the pot (or three months additional repayments) to support and resource ongoing church planting across AoG-GB. This ‘seed donation’ is not obligatory, but will be highly encouraged so a pioneering culture continues to be established across the movement. By doing so, you will be well-positioned to champion others in the church planting journey!

If you are ready to plant a new church out of your existing one, you will be able to make a new application via the Initial Enquiry form.